The price per tonne of carbon has tripled since 2020. In fact, this price is having a high impact on the historical record of electricity costs that we are experiencing these days. But it’s not all bad news: you can monetise your company’s carbon footprint. Monetise your carbon footprint, yes, you read that right. The carbon dioxide emissions your company produces can help you make a profit, and we explain how in this article.

CO₂ Emission Regulations in Europe

High carbon dioxide (CO₂) emissions are one of the causes of rising temperatures and thus climate change. Almost every human activity generates CO₂ emissions. From going to work to going on holiday: everything has a ‘carbon footprint’.

To try to encourage companies to reduce their emissions, the European Union launched a “CO₂ emissions trading system”. This particular mechanism imposes a fixed cap or a legally binding GHG reduction target, for heavy energy-using installations such as power plants, factories, industrial plants and chemical plants.

If you don’t know it accurately, or you don’t have up-to-date data on your carbon footprint, you could end up paying extra! So, the first tip for monetising your carbon emissions is to be able to calculate your company’s carbon footprint. Only then you will know if you are in line with the European target: emissions cuts of at least 40% by 2030. The European Green Deal will raise the target to 55% in accordance with the 2021 regulatory updates on greenhouse gas emissions.

How the CO2 Emissions Market Works

This mechanism is a kind of carbon emissions “stock exchange” where the CO2 emission allowances granted to each company are traded. The rate or value of these allowances is known as EUAS (European Emission Allowances).

This market is regulated by the EU, which allocates allowances through the EU ETS (EU Emissions Trading Scheme).

In the context created by Brexit, a UK Emissions Trading Scheme (UK ETS) replaced the UK’s participation in the EU ETS on 1 January 2021. The 4 governments of the UK established the scheme to increase the climate ambition of the UK’s carbon pricing policy, whilst also protecting the competitiveness of UK businesses.

This market for “CO2 emission values” is just another speculative market, which works on the basis of the golden rule of capitalism, which is supply and demand.

This has led to the emergence of a market to buy and sell emissions allowances. This trading scheme is known as the ETS (Emissions Trading Scheme) and has been in place since 2005.

The CO2 Price Situation

A report published in 2018 by the Carbon Tracker organisation predicted that the price of carbon allowances could reach €25 – €30 by 2020-21. But these numbers have fallen short. It is now 2021 and the price is already over €40/t, a price much higher than expected.

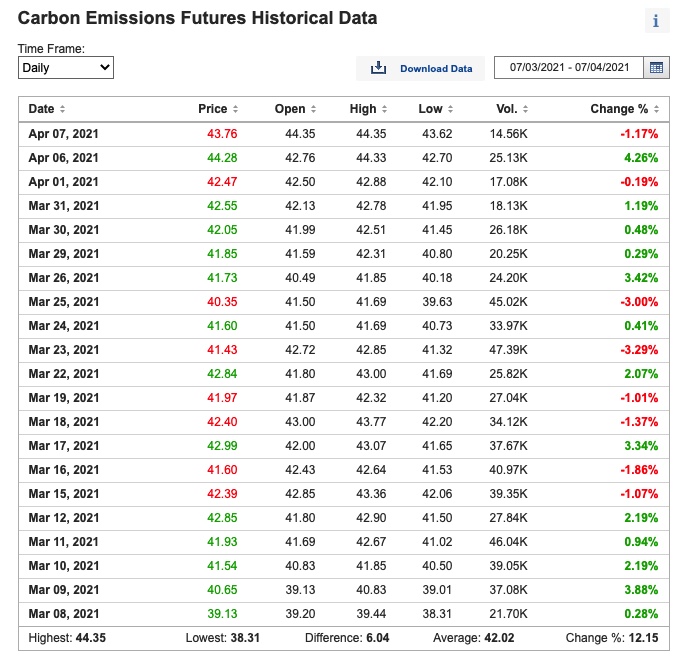

In fact, the EUAs price has risen from €4.38/t in May 2017 to €42.15/t at the end of March 2021, reaching record highs since 2005. And the trend is on the rise and is likely to continue (Source).

On the one hand, countries like Poland have once again asked the European Commission to investigate sharply rising EU carbon prices, as trading data shows speculators are building larger positions in the market. On the other hand, and more obviously, the Covid-19 effects in the European countries are weighing on the growth prospects of EU economies.

In addition, informal talks between EU member states on the Climate Bill, a higher emissions reduction target for 2030 under the European Green Deal, and the new legislative reforms mean that the price trend for CO₂ is upwards. As a consequence, the cost of EUAs will not come down until the EU’s regulatory uncertainty is over.

To conclude, the price has started to rise steadily as a result of these events. It is expected to continue to rise in the coming years in the EU, reaching €55/tonne (4 times its cost) by 2030, according to the Carbon Tracker report. Which, as we can see, was an optimistic assessment already falling short… And all this to accelerate the end of CO₂ emissions.

How to Monetise your Carbon Footprint

1. Calculate your Carbon Footprint

Many companies do not calculate their carbon footprint, as it takes some effort. Especially in terms of time, as you have to take into account ALL the energy sources you consume.

In other words, you must transform not only the electricity you consume but also the emissions of your vehicle fleets, if you have them, into tonnes of CO₂.

The good news is that all this can now be done in an automated way and with mathematical formulas as precise as you need, thanks to the Carbon App that you can find on our platform, DEXMA Energy Intelligence. Here is a tutorial guide on how the Carbon App works.

2. Reduce your Carbon Footprint with Advanced Technologies

With these measures, you will avoid penalties for non-compliance with the obligation to surrender EU ETS allowances granted to your power plant or factory.

In addition, you will save on energy costs as a result of implementing these improvements. You may opt for more energy-efficient equipment that consumes less energy, or for renewable installations that move towards self-consumption. This will depend on your company’s energy efficiency strategy and goals.

3. Sell the CO2 emissions that you have not consumed

If we take into account that the CO₂ emissions market allows you to sell and buy the emissions granted to each company, a new opportunity arises to monetise your carbon footprint.

There are countries and companies that pollute less than what they have been set and all thanks to the energy efficiency strategies they have implemented.

If your power plant, industrial plant or factory is becoming more efficient and environmentally friendly, your carbon footprint will be smaller. So if you have any allowances left over, you can sell them on the emissions market. And given the current price trend, the profit can be enormous.

Last but not least. If your company is not affected by the obligation of being part of the ETS system, there are still multiple benefits of GHG management for you!

- Reduce your energy costs: larger GHG emission sources are also the most energy-intensive. GHG emission accounting, management and reporting systems like DEXMA Analyse will let you monitor the energy source and identify GHG emission reduction projects internally which can lead to cost-saving for the organisation.

- Risk and opportunity management: due to increasing concern about climate change, governments across the world are creating regulations to restrict emissions. Currently, affected sectors are energy, transportation and heavy manufacturing, but who tells your sector won’t be also affected in the future?

- Communication and branding: status reports on carbon emissions when published along with the annual reports make a strong statement to stakeholders that the company manages its businesses responsibly. These reports can be presented at various forums depending on companies’ target stakeholders e.g. investors, lenders, and governments. It will also help in enhancing the brand image of your company!