As you may have already seen during these weeks, our Energy Management Report has been recently published. With this, we have broken down the analysis by examining perspectives based on the type of organisation. Today it’s the turn of companies in the tertiary sector.

In the 2023 Energy Survey, we had the honour of receiving insights from professionals representing a diversity of roles, companies, and sectors within the industry. Although the majority of responses come from energy companies such as Energy Service Companies, retailers, renewable energy firms, or hardware manufacturers, we have also received responses from non-energy related companies.

We refer to these organisations as the Tertiary industry. In 2023, 25% of the participants come from sectors as diverse as real estate, industrial, financial, tourism, educational, public administration, or logistics.

If you are a professional in any of these sectors and energy is one of your priorities, this article will surely catch your attention. Furthermore, the participation of profiles like yours in the survey provides us with a more comprehensive view of the energy landscape, not only from the perspective of specialised companies.

It will also be relevant to you if you work in an Energy Services Company, as it will provide you with a summary of the needs of your potential clients.

State of the Energy Management for Tertiary Sector

Once we published our Energy Report, we have been releasing several articles focusing on the challenges, services, and priorities of Energy Service Companies and Utility Companies. Today, we turn our attention to the energy management of companies located at the end of the chain, which may include schools, hospitals, or service sector enterprises, among others. What responses did we obtain in the energy survey, and how do these responses reflect the current energy landscape? Let’s find out.

The year 2023 was a year in which companies had to make a significant number of energy-related choices. On the one hand, as a result of the rise in energy prices in 2022. And on the other hand, due to the Regulations and new Energy Efficiency Directives established by the European Union.

Increase of the Energy Costs in Companies

Surely you have noticed that efficient energy management is no longer just a practice to preserve resources and reduce emissions, but it also plays a vital role in the financial stability of companies.

The 2023 Energy Survey has shed light on the energy cost rises and consumption patterns within organisations, offering a nuanced understanding of the financial and operational impacts of the current energy landscape. This section delves into the complexities of these cost increases and the main sources of energy consumption, providing insights into the challenges and strategic responses of businesses as they navigate a shifting energy economy.

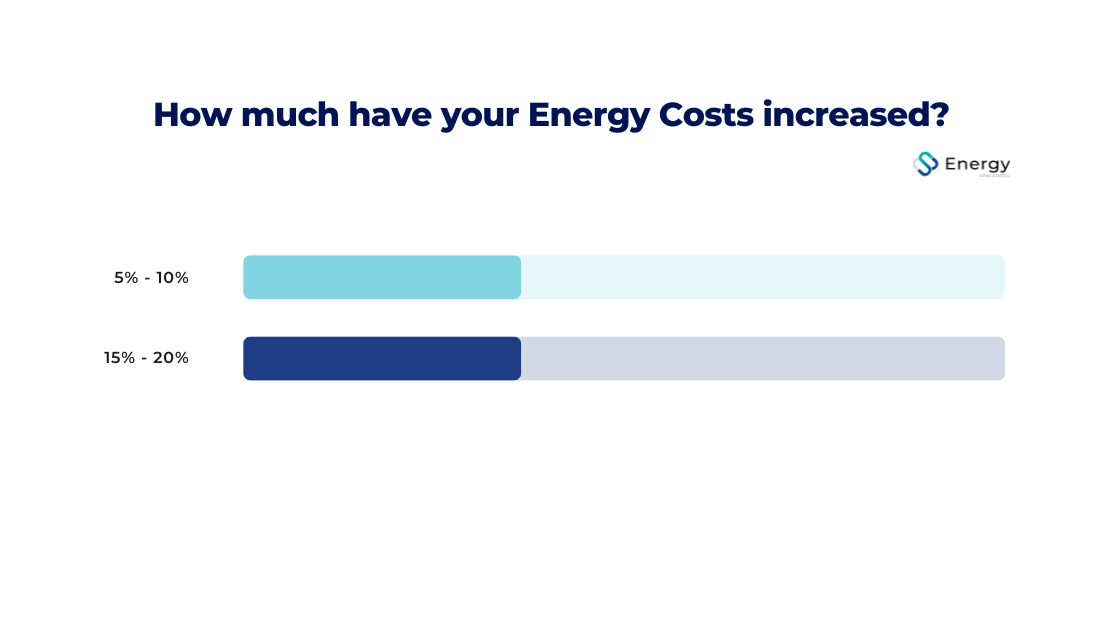

Survey participants have depicted an industry grappling with substantial energy cost hikes. A noteworthy 33.30% of businesses report a cost increase ranging between 15-20%, while another 33.30% have witnessed a rise of 5-10%. These statistics underscore the direct repercussions of the energy price surge in 2022-2023, emphasising the imperative for organisations to adopt measures that can mitigate the financial strain of escalating energy expenditures.

Therefore, there is a clear need for solutions that not only address energy consumption passively but also activate continuous improvement processes for optimization and efficiency. Companies face the challenge of balancing the need to maintain optimal performance with minimising operating expenses, something that is only possible through proactive and innovative energy management.

Top 4 Challenges for Energy Managers in 2023

Within the demanding field of building and facility management, energy managers face a complex task in overseeing multiple sites. The 2023 Energy Survey sheds light on this reality, where efficiency and energy savings must be addressed with a multidimensional approach.

Let’s delve into the main challenges encountered by our respondents.

Managing Multi-localisation Projects

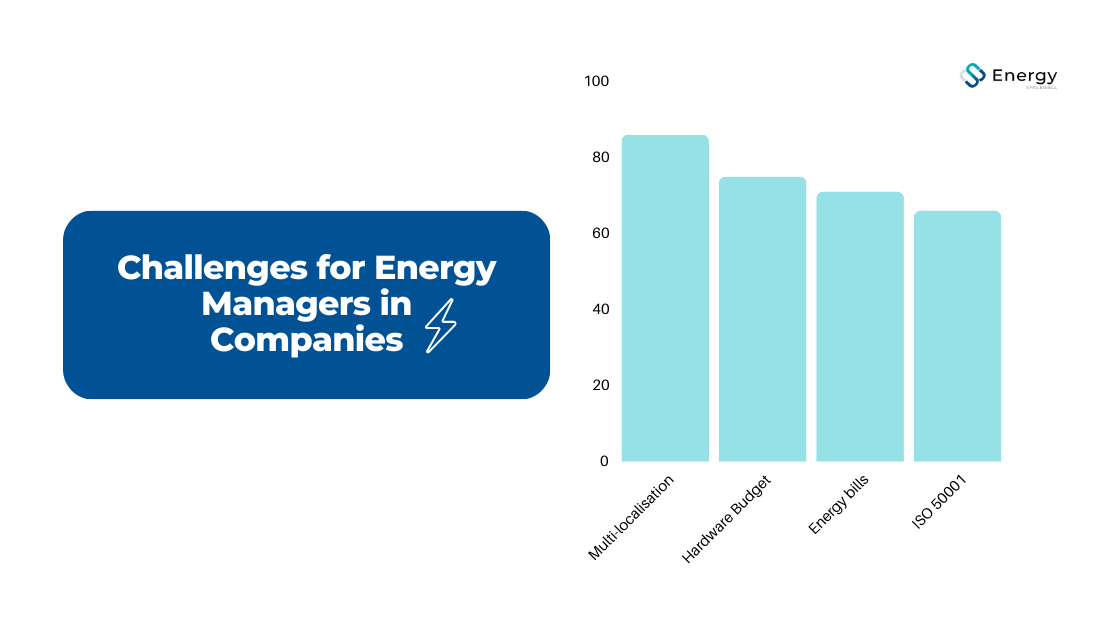

With a significant percentage of professionals managing between 2 and 10 facilities, the greatest challenge lies in identifying and implementing improvements that result in effective energy savings within each specific location.

An overwhelming 85.70% of participants recognize the challenge of swiftly and cost-effectively identifying which buildings to prioritise and determining necessary efficiency enhancements. This underscores the necessity for a more efficient method for energy audits and the strategic prioritisation of interventions, guaranteeing that resources are directed towards areas offering the highest potential for savings.

Moreover, initiating the initial analysis of buildings poses a challenge for 35.70% of survey respondents, suggesting that the early phases of energy management can be daunting, especially when handling a considerable number of properties. This obstacle underscores the necessity for clear methodologies and tools that can streamline the initial assessment and establish the groundwork for sustained energy management endeavours.

Budget for Installing Monitoring Hardware

Three-quarters (75%) of respondents encounter challenges in obtaining funding for installing monitoring hardware across all sites.

This financial limitation highlights the significance of affordable solutions and the potential for scalable technologies capable of delivering essential energy data without imposing prohibitive initial investments.

Collecting and Tracking all Energy Bills

Gathering and managing all energy bills systematically poses a challenge for 71.40% of survey participants, highlighting the administrative burden associated with overseeing energy data across numerous sites.

The capacity to centralise and analyse billing information is essential for precise cost distribution, budgeting, and pinpointing opportunities for cost minimization. This is when an EMS like the Spacewell Energy Platform comes into play, effectively monitoring and visualising the real-time consumption of each building and making energy savings projections for each location.

ISO 50001 Certification

Awareness and adoption of certification vary, with 33.30% either considering or unfamiliar with ISO 50001. For those who are aware, achieving ISO 50001 Certification presents challenges, particularly in detecting and verifying energy savings in existing projects (66.70%). This highlights the importance of robust measurement and verification processes inherent in the ISO 50001 framework.

Additional challenges include reducing carbon emissions and managing CSR/ESG compliance (66.70%), underscoring the growing emphasis on sustainability. Compliance with energy regulations is noted by 33.30%, reflecting the complexity of the regulatory landscape.

Securing funding for energy efficiency projects and justifying ROI (33.30%) emerge as financial challenges, emphasising the need for clear communication regarding economic benefits to secure investment for long-term energy savings.

Heading towards Energy Efficiency in Organisations

It is evident that the present circumstances are prompting companies to reconsider their energy consumption practices, and they are progressively inclined towards implementing energy-saving measures. Energy efficiency is emerging as a critical factor in organisations of varying sizes. Surveys indicate that professionals are growingly mindful of the energy consumption within their buildings and are striving to mitigate it.

You are welcome to download the full Report of the Energy Management Survey. If your organisation is considering implementing an EMS to achieve real energy savings, you can contact us at any time. We will be happy to assist you!